Venture Studio Family

Capital Networking Virtual Conference

Private Equity, Real Estate, Venture Capital, Hedge Funds, Crypto Funds, Angels

Max Pog: The Builder Behind the Builders

Venture Studio Family

Capital Networking Virtual Conference

Private Equity, Real Estate, Venture Capital, Hedge Funds, Crypto Funds, Angels

How one founder is reshaping the venture studio landscape through community, research, and virtual infrastructure.

In a world of flashy tech headlines and unicorn hype cycles, Max Pog is doing something more grounded — and perhaps more impactful: he’s building infrastructure for the people who build startups.

Currently based in Lisbon, Max is the founder of the Venture Studio Family, a global community of venture studios that share financial data, playbooks, investor contacts, and capital-raising strategies. It’s a network built not just on ideas, but on execution.

Max’s entrepreneurial track record is long: he launched his first company at 16, sold it at 17, and went on to found a projection mapping software company (POGUMAX), an online education platform (BDR Academy), and now a global research initiative into venture studios.

That initiative led to the Big Venture Studio Research reports (2023 and 2024), likely the most comprehensive datasets available on how venture studios perform. Across 3,000+ deals and hundreds of respondents, the findings are already influencing investors and operators worldwide.

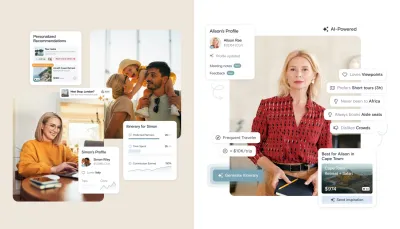

But Max’s most visible initiative is the Capital Networking Virtual Conference. Held entirely online, the event connects thousands of investors and founders through data-driven 1:1 matchmaking and dense programmatic content. It’s a bold attempt to redesign how capital flows— replacing gatekeepers with smart filters, and exclusivity with access. It’s not always elegant, but it’s brave, open, and deeply aligned with Max’s ethos: make innovation accessible, and let the network do the work.

To understand the philosophy behind these efforts — and where they might lead — we asked Max a few questions.

1. With your Venture Studio Research, you’ve gathered the most comprehensive data set in this space. Based on what you’ve seen, what systemic blind spots do investors still have about the venture studio model?

There is still a lot to learn about the return profile of venture studios. There is not enough data about IRR & especially DPI of venture studios, as most studios were created in the last 10 years, and the overall number of studios is relatively low to get enough statistical data through independent platforms like Pitchbook.

2. If you were launching a new venture studio today, what would you do differently from the traditional model — especially with what you now know from research and experience?

I would probably do a completely different format – launching bootstrap/seedstrap companies with hired teams of professionals and leveraging AI to speed up processes & keep expenses / teams very lean to breakeven faster. In my experience, I've launched 4 profitable businesses from scratch, so this is what I naturally am trying to do when launching a company – make it profitable as soon as possible. I also am not sure that I would partner with existing entrepreneurs – instead I would hire professionals to keep equity in the studio and be fully responsible for success or failure of its ventures.

3. You’ve essentially built a decentralized dealflow engine through your conferences. Do you see this as the beginning of a new investment infrastructure — one where networks matter more than brands?

I'm still experimenting with the event format to make it more valuable for everyone involved – being it an angel, VC, Family Office, Fund of Funds, founder, fundraising advisor or CVC. Now we try to simplify fundraising for startups allowing them to book calls directly into the calendars of investors who match this particular startup by stage, investment geography and industry/sector. Now, startups can schedule calls with investors and GPs can book calls with LPs through our platform at https://app.inniches.com – you can check how this works in the description of this service at https://inniches.com/c#reg. We're trying to make it very easy to schedule 10-minute calls with relevant investors for pitch & networking.

4. Your latest event brought together over 4,000 players in the VC world. What did you learn? What surprised you — and what would you change next time?

For the first time, we tried to gather together 3 audiences:

- LPs (incl. Family Offices, Funds of Funds, Ultra High Net Worth Individuals)

- GPs of funds and different investors, including Private Equity, Real Estate, Venture Capital, Hedge Funds, Crypto Funds, angels

- Startups

Even if we succeeded and we got all types of investors & startups together, in my opinion, it's still hard to craft an experience to let it be perfect for each participant. So next time, we'll try to make events more narrow, focusing on specific verticals, like AI, Healthcare, Fintech, and so on. And I have to still to watch all the recordings from the event, because during live sessions it's typically hard to perceive content as we host the event, communicate in our team and manage dozens of speakers simultaneously :)

5. Long-term, what role do you believe virtual communities will play in reshaping how innovation is financed? Are we just digitizing old systems, or building an entirely new capital stack?

I think virtual communities & conference will not replace the physical ones. Virtual events is +1 way to be more close to investors, understand what happens in the capital world and give an opportunity to extend the network of each participant without flying to another city or country, booking a hotel and dedicating several days for a physical event. Less friction to join, less friction to speak – this is why so many people like and join our events.

From research to community-building to capital matchmaking, Max Pog is designing blueprints for a more open, informed, and scalable future of entrepreneurship. We’re excited to see how his work continues to evolve — and how it might reshape the way innovation is funded, built, and shared.