Airlines industry

The Tariff Wars and Aviation – Impacts for Ancillaries?

Airlines industry

If the cost-of-living crisis continues, particularly with the escalating tariff wars, what will be the propensity for passengers to book flights, and, more interestingly, to continue to gain such revenue from the ancillaries that come from beyond just paying for a seat from A to B?

Predictions for year-end 2024, highlights that airline ancillary revenues will be just under $150 Billion worldwide – which is 26% above 2023 and nearly $39 billion above the pre-pandemic year of 2019. So, ancillaries are a key component for airlines. However, the range of importance can go from just 2% of total revenues from ancillaries, to, carriers with over 50% of their revenues coming from such ancillary ‘a la carte’ services (such as baggage, seats, etc,), as well as commissions form 3rd party sales (hotels, car hire) as well as selling miles to credit card companies as rewards for loyalty programmes. In essence, many airlines rely heavily on the extras. But, will the passenger be savvier in the future, and, see ways to buy ‘cheap travel’, but not pay for the additional products and services.

All predictions are showing that summer 2025 will have robust capacity levels, as, airlines have been very bullish in the positioning of flights and seats. Just taking the US to Europe as an example, carriers are offering around 15 million seats (in and out) across the Atlantic for the summer period. This is equates to a growth of around 5,000 additional seats per day when comparing back to last summer. So, for those airlines that need more than just seat revenue, what can be a way to adapt to the ancillary phenomenon, and, utilise innovation and big data as a way to continue to get more across the full passenger journey?

Airline ancillaries are basically add-on services and products offered by airlines beyond the basic travel of passengers. These services are designed to enhance the travel experience and provide added convenience to passengers. Broadly, the key components of ancillaries can be summarised as:

- Baggage Fees: Airlines keep making a lot of money from charging for extra bags and checked bags. Is this a trend that will continue?

- Seat Selection Fees: Passengers prefer choosing better seat options on planes. Why can’t we just wait for online check-in to open, and, not care where we sit?

- In-Flight: Products and services such as in-flight Wi-Fi, food, and entertainment on planes are becoming quite profitable, and, airlines are working both with tech companies to make flying more enjoyable, as well as with 3rd party catering companies to have a strong ‘on-board’ menu offer;

- Loyalty: Frequent flyer programmes are a big source of income as banks and credit card companies look to purchase ‘miles’ from airlines as a way to support and incentivise customers for their daily shopping and spend;

The types of ancillary services offered along with their importance can vary in different parts of the world. For example, budget airlines in Europe and Asia have been the first to use extra services to keep ticket costs low but still make a profit. Ryanair, the biggest budget airline in Europe, said that extra income made up 40% of its total income. On the other hand, the big legacy airlines in North America focus on high-quality services and loyalty programmes.

The Data-Driven Future of Ancillary Revenue

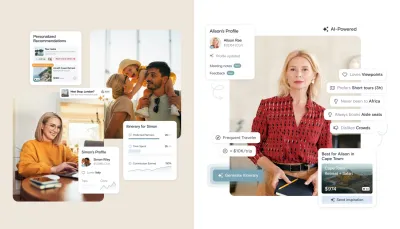

Innovative techniques such as continuous pricing and AI-powered personalization will boost ancillary revenue streams even more and such management approaches will help airlines customize services using passenger data, creating a more tailored and profitable travel experience. And, in particular, the following will shape ancillary revenue strategies:

- Personalization and data analytics – airlines use data analytics to provide more customized or rather personalized ancillary services, which makes passengers happier and increases revenue through targeted promotions;

- Digital transformation – ancillary services have gone digital, which makes it easily accessible and convenient for passengers to buy extra services through apps/sites;

- Dynamic ancillary pricing – airlines are going to adopt flexible pricing models that will let them change the ancillary service prices based on the passenger needs and based on the market conditions, allowing them to make more revenue.

As the airline industry continues to evolve, the ability to dynamically adapt and innovate isn’t just a nice-to have but a must-have strategy. Every airline company, whether a low-cost carrier or a full-service carrier, experiences its own set of challenges and opportunities pertaining to ancillary revenue. That’s why a one-size-fits-all approach may not be the answer, instead, each segment requires a customised strategy that supports revenue maximisation, at the same time as meeting the diverse needs of its passengers.

For Low-Cost Carriers (LCCs) who are known for their no-frills approach, much emphasis has been placed on ancillary revenues as a way to keep base fares low – where the focus is on creating a broad array of optional services that passengers can choose from. Innovations in this segment could include dynamic pricing models that adjust in real-time based on demand, personalized bundles that cater to frequent travellers, and, seamless integration of third-party services like car rentals and hotel bookings into the carriers booking platforms.

Moving to the other end of the spectrum, the Full-Service Carriers, who cater to a broader spectrum of travellers including business and premium passengers, the opportunity here lies with leveraging their brand equity and customer loyalty programs to drive ancillary sales. In particular, focusing upon enhancing the value of existing services, such as premium seating and onboard dining, through dynamic packaging that aligns with passenger preferences.

Envisioning the Future with Dynamic Ancillary Scenarios

So, how can airlines tailor their ancillary strategies to meet the needs of different customer segments, enhance profitability, and create a more engaging and personalized travel experience. These scenarios below touch different part of the travellers’ journey from start to end and form a blueprint for the future of airline ancillaries.

- Dynamic bundling for personalisation – rather than offering a static set of bundled services, airlines can use data analytics to create personalised bundles in real-time. For example, a business traveller who frequently books last-minute flights might be offered a bundle that includes a premium seat, expedited security screening, and access to an airport lounge, all at a dynamically adjusted price.

- Real-Time ancillary pricing based on market conditions – how airlines adjust ticket prices in real-time, the same can be done for ancillary services? This dynamic pricing model would consider various factors such as demand, competition, and even external factors like weather or economic conditions. For instance, the price for checked baggage could fluctuate depending on the time of day, the route, or even the traveller’s frequent flyer status. This approach allows airlines to maximise revenue by capturing the maximum willingness to pay at any given moment.

- Expanding the Ancillary Ecosystem – the future of airline ancillaries is not limited to traditional services like baggage fees or seat selection. Airlines have the opportunity to expand their ancillary ecosystems by partnering with other travel and lifestyle brands. This could include offering travel insurance, destination experiences, or even retail products as part of the booking process. By integrating these services into the booking and post-booking stages, airlines can create a seamless travel experience that extends beyond the flight itself.

- Leveraging AI for predictive ancillary sales – as airlines gather more data on passenger behaviour, the use of artificial intelligence (AI) to predict ancillary sales is becoming increasingly feasible. Imagine a scenario where an AI system analyses a passenger’s past purchases, flight history, and even real-time data. For example, a passenger who frequently buys in-flight Wi-Fi might receive a personalized offer just before boarding, with a dynamically adjusted price based on their loyalty status and the demand on that particular flight.

In conclusion, the ancillaries offer is a way for airlines to look at revenue generation beyond just travel, but, in any downturn and economic hardship, these may be the first to be stopped. So, it is crucial that any airline in this space is looking at how best to use new technologies, and data for personalisation; providing the traveller with a menu of opportunities. Getting them to pick what they want is the challenge, but for an airline to have a robust offer in such extras has to be available, and, brough to the attention of the prospect (traveller). As the famous positioning quote highlights; “it is not what you do to the product, but what you do to the mind of the prospect”. Having the offer positioned, and using technologies to make the offer desirable and easy to buy, is, the first part of the challenge solved.